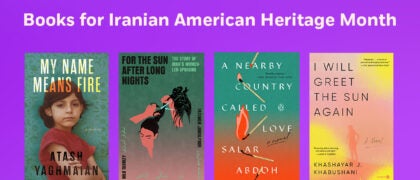

Books for Iranian American Heritage Month

In honor of Iranian American Heritage Month in March, we are sharing books by Iranian American authors and books about Iranian culture to educate and inspire students. This collection includes literature, memoir, and history.