Preface

1: The Latest Phase of American Capitalist Development

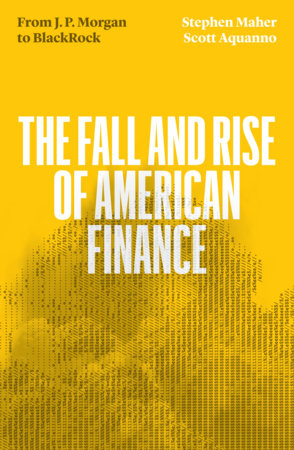

The Fall and Rise of American Finance

A New Picture of Financialization

Rethinking Finance and the Corporation

2: Classical Finance Capital and the Modern State

Financial Capital and Industrial Capital

From Bank Capital to Finance Capital

Finance Capital and Competition

State Power, Class Power, and Crisis

3: Managerialism and the New Deal State

Remaking Capitalist Finance

The New Industrial Order

Class Struggle and the Crisis of Managerialism

4: Neoliberalism and Financial Hegemony

The Financialization of the Non-Financial Corporation

Asset-Based Accumulation and Market-Based Finance

Financialization and Authoritarian Statism

The 2008 Crisis and the Question of Decline

5: The New Finance Capital and the Risk State

Crisis Management and the Risk State

The Rise of the Big Three

The New Finance Capital

Private Equity, Hedge Funds, and Finance Capital

6: Crises, Contradictions, and Possibilities

The Statization of Market-Based Finance

The Macroeconomic Policy of Finance Capital

The False Promise of Universal Ownership

Democratizing Finance

Notes

Index