<section epub:type="cover" id="sec-cover001"> </section><section epub:type="frontmatter" id="sec-abouttheauthor001">

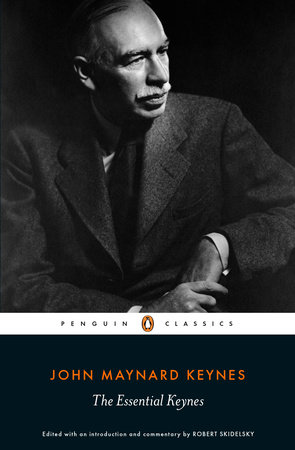

PENGUIN CLASSICS

THE ESSENTIAL KEYNESJOHN MAYNARD KEYNES (1883–1946) is widely considered to have been the most influential economist of the twentieth century. His key books include The Economic Consequences of the Peace (1919); A Treatise on Probability (1921); A Tract on Monetary Reform (1923); A Treatise on Money (1930); and his magnum opus, The General Theory of Employment, Interest and Money (1936).

ROBERT SKIDELSKY is Emeritus Professor of Political Economy at Warwick. His three-volume biography of Keynes received numerous awards, including the Lionel Gelber Prize and the Council on Foreign Relations Prize.

</section><section epub:type="titlepage" id="sec-titlepage001">

John Maynard Keynes

------------------------------

THE ESSENTIAL KEYNES

Edited and with an Introduction by

ROBERT SKIDELSKY</section><section epub:type="copyright-page" id="sec-copyright001"> </section> <section epub:type="toc" id="sec-toc001">

One: THE PHILOSOPHER

Two: THE SOCIAL PHILOSOPHER

Three: THE ECONOMIST

Four: THE POLICY-MAKER

Five: THE ESSAYIST

</section> <section epub:type="preface" id="sec-dedication"></section><section epub:type="epigraph" id="sec-epigraph">

‘Economics is a very dangerous science’

John Maynard Keynes,

‘Thomas Robert Malthus’

</section><section epub:type="preface" id="sec-preface">

Preface

I have arranged the selected material in such a way as to help the reader rather than for strict consistency. Almost all the excerpts are taken from The Collected Writings of John Maynard Keynes, published in thirty volumes between 1971 and 1989. They are numbered sequentially and are identified by the volume number (CW, 10), title and date of original publication. The page numbers of the volumes of the Collected Writings from which they are taken are included in square brackets, marking the end of the page they refer to. I have grouped together some excerpts under the following topics: The Great Depression, Policies for the Slump, The New Deal and Full Employment Policy. Those readers who want a quick education in Keynes as an analyst of, and policy-maker for, slumps should turn to excerpts 18, 28–31 and 33.

This collection would not have been possible but for the magnificent Collected Writings. Elizabeth Johnson was the first editor; she was succeeded by Donald Moggridge. I would like to thank the Royal Economic Society for permission to publish excerpts from these volumes; King’s College, Cambridge for permission to publish excerpts 1, 2, and 3 from the unpublished papers of J. M. Keynes; Paul Davidson, Meghnad Desai, Geoff Harcourt, Pete Mills and Rod O’Donnell, for their comments on sections of the draft; King’s College archivist Patricia McGuire in helping me locate some handwritten notes in the Keynes Papers; and my impeccable copy editor, David Watson. My research assistant Pete Mills was invaluable in downloading the material I selected from the electronic edition of the Collected Writings.

</section><section epub:type="preface" id="sec-preface003">

List of Abbreviations

CW The Collected Writings of John Maynard Keynes

EB Essays in Biography

ECC ‘The Economic Consequences of Mr Churchill’

ECP The Economic Consequences of the Peace

EP Essays in Persuasion

EPG ‘Economic Possibilities for our Grandchildren’

GT The General Theory of Employment, Interest and Money

JMK John Maynard Keynes

KP Keynes Papers, King’s College, Cambridge

ICU International Clearing Union

QTM Quantity Theory of Money

RT A Revision of the Treaty

TMR A Tract on Monetary Reform

TM A Treatise on Money

TP A Treatise on Probability

</section><section epub:type="introduction" id="sec-introduction">

Introduction

‘Keynes’s ideas will live so long as the world has need of them’

Robert Skidelsky

IThere are hardly any single-volume selections of Keynes writings, and no comprehensive ones.1 This selection aims to make them much more accessible to both students of economics and the general reader perplexed and confused by the war of economists which broke out afresh with the economic collapse of 2008. By this time Keynes’s star had long been in eclipse. A new orthodoxy had arisen which cut economics off from the rest of life, claimed that market economies were naturally stable, and that the only macro-economic task of government was to maintain sound money. Robert Lucas, the high priest of the new classical economics, is said to have told his students at Chicago University, ‘We need spend only ten minutes on Keynes; we know it doesn’t work.’ The things which worked were unimpeded markets.

Keynes had set out to destroy the argument of ‘classical’ economics that a competitive market economy would always ensure full use of potential resources. He invented almost singlehandedly a new branch of economics, macro-economics, to show why this was not true, and to justify active fiscal and monetary policy. The task of overturning orthodox theory seemed all the more urgent in the wake of the Great Depression of 1929–33. The result was The General Theory of Employment, Interest and Money, whose publication in 1936 is conventionally taken to be the start of the Keynesian Revolution. Its main policy fruit was the commitment, till the mid-1970s, by most Western governments, to maintain high and stable levels of employment. The charge that Keynes failed to provide secure micro-foundations for his macro-theory, as well as the contentious implications of that theory for the role of state, led to the view that Keynesian theory was flawed and Keynesian policy led to inflation.

So when the world economy collapsed in 2008–9 the only thing most younger economists, policy-makers and businessmen knew about Keynes was that one did not need to know anything about him. He had largely vanished from their textbooks, briefings and indeed from their consciousness. This left them unprepared for the catastrophic nature of the economic collapse. Today macro-economics is disabled. We are still struggling experimentally with the aftermath of the banking collapse. People talk of the need for a new Keynes. But the old Keynes still has superlative wisdom to offer for a new age.

Students and others are hungry for clues to the riddle of economic life. There have been many books about Keynes, including a rather massive one of my own. But Keynes’s own writings are largely unavailable. The purpose of this single-volume Keynes reader – I have called it The Essential Keynes – is to give the reader a flavour of the quality of Keynes’s mind, style and range, and his approach to ethical, theoretical and practical problems which, so far from having vanished, clamour for a contemporary answer. Keynes is known, if at all, only as the creator of a short-run theory of fiscal stabilization. This was the fiscal tool which emerged from the ferment of ideas in his day. But it was in his explorations of the problem of capitalist instability, and his futurist vision of a world without work, that many today will find their inspiration. My hope is that the selections I have chosen, which include some writings never before published, will provide both meat for the student and food for a wider public. Above all, this book provides readers with the opportunity to acquaint themselves with one of the most remarkable thinkers and characters of the twentieth century.

IIJohn Maynard Keynes was born at 6 Harvey Road, Cambridge, England on 5 June 1883 into an academic family. He was the eldest son of John Neville Keynes, a logician and economist, and Florence Ada Brown, the daughter of a Congregational divine. He had an outstandingly successful school career at Eton College, which was followed by an equally glittering undergraduate one at King’s College, Cambridge, where he gained a first-class honours degree in Mathematics, wrote papers on the medieval theologian Peter Abelard and the Conservative political philosopher Edmund Burke and became president of the Cambridge Union and the University Liberal Club. Of crucial importance to his intellectual and moral formation was his election, in 1902, to the Cambridge Apostles, an exclusive ‘conversation’ society, where he fell under the influence of the philosopher G. E. Moore, and which brought him the friendship of the subversive biographer Lytton Strachey. Moore’s Principia Ethica remained his ‘religion under the surface’ for the rest of his life. It taught that the highest forms of civilized life were friendship, aesthetic enjoyments and the pursuit of truth. His economic activities were always in the service of these ethical goals. That is why he wanted the economic machine to work full blast till the material conditions for the ‘good life’ were achieved, at which point economists might retire in favour of philosophers.

In 1906 Keynes was placed second in the Civil Service Examination, his worst marks being in economics, which he had studied briefly under Alfred Marshall, professor of economics at Cambridge University. (He never got a degree in economics.) After two years in the India Office, in which he wrote a thesis on probability in his spare time, he started lecturing on monetary economics at Cambridge; in 1909 his thesis won him a fellowship at King’s College, which remained his academic home for the rest of his life. His membership of the Bloomsbury group, a commune of Cambridge-connected writers and painters who lived in the Bloomsbury district of London, dates from the start of his friendship with the painter Duncan Grant, Lytton Strachey’s cousin, in 1908. In 1913 he published his first book, Indian Currency and Finance, and served on the Royal Commission on Indian Finance and Currency. Cambridge and Bloomsbury formed the two fortresses of his spiritual life, from which radiated out his friendships, interests and activities in the great world of affairs.

Keynes’s advice to the UK Treasury helped to avert the collapse of the gold standard in the banking crisis of August 1914 which accompanied the outbreak of the First World War. From January 1915 to June 1919 he was a temporary civil servant at the Treasury, showing a notable ability to apply economic theory to the practical problems of war finance. He was against military conscription and would have been a conscientious objector had his Treasury work not exempted him from military service. When Lloyd George succeeded Asquith as prime minister in December 1916, Keynes, then aged thirty-four, became head of the Treasury’s new ‘A’ Division, set up to manage Britain’s external finance. He helped build up the whole system of inter-Allied purchases, while chafing at Britain’s growing dependence on American loans and the failure to arrange a compromise peace.

Keynes was chief Treasury representative at the Paris Peace Conference in 1919, where he tried unavailingly to limit Germany’s bill for reparations, and to promote an American loan for the reconstruction of Europe. His resignation from the Treasury on 5 June 1919 was followed by the publication, in December, of The Economic Consequences of the Peace, the book which first brought him international fame. A bitter polemic, informed by both economic argument and moral passion, against Lloyd George’s policy of trying to make Germany pay for the war ‘till the pips squeak’, it reflected his fears for the future of European civilization. Unless the Versailles Treaty were drastically revised, vengeance, he predicted, would follow.

In 1925 he took the lease of Tilton, a farmhouse in East Sussex, next door to Charleston, where Duncan Grant lived with the painter Vanessa Bell. This move coincided with his marriage to the Russian ballerina Lydia Lopokova, for whom his love and fascination never waned, who softened the edges of his astringency and who gave his life the emotional stability and regular routine for sustained intellectual effort. Thereafter, his life was divided between Cambridge, London, and East Sussex.

He was a spectacularly successful investment bursar of his college, King’s College, and despite some major reverses, made a small fortune for himself. He was worth £400,000 (£14 million, or $22 million in today’s values) when he died. In London, where he rented a house at 46 Gordon Square, he was, at various times, on the boards of five investment and insurance companies, the chief one being the National Mutual Life Assurance Company, which he chaired from 1921 to 1937. Between 1923 and 1931 he was chief proprietor and chairman of the board of the weekly journal the Nation and Athenaeum, contributing regular articles on financial and economic topics. He remained chairman of the board of the New Statesman and Nation when the two journals merged in 1931. Between 1911 and 1945 he edited the Economic Journal. In the 1920s his ideas on economic policy permeated Whitehall through monthly meetings of the Tuesday Club, a dining club started by his friend and stockbroker, Oswald Falk. In the 1930s, he sought to influence policy through his membership of the prime minister’s Economic Advisory Council.

In the 1920s the post-war European inflations, succeeded in Britain by heavy unemployment, formed the background to his two theoretical books A Tract on Monetary Reform (1923) and A Treatise on Money (1930), which dealt with the causes and consequences of monetary instability, and their remedies. These theoretical books chronicle Keynes’s ‘struggle to escape from the stranglehold of the Quantity Theory [of Money]…’2 They were punctuated by two notable polemical pamphlets, ‘The Economic Consequences of Mr Churchill’ (1925) and ‘Can Lloyd George Do It?’ (1929), the latter co-authored with Hubert Henderson. The first attacked Churchill’s decision, as chancellor of the exchequer, to put the pound back on the gold standard at an overvalued exchange rate against the dollar; the second was a plea for a large programme of public investment. Reconciled to Lloyd George in 1926, Keynes attempted to provide the Liberal Party with a social philosophy of the ‘middle way’ between individualism and state socialism, suitable for an inflexible industrial structure. Regulation of demand, he would later write, was the only way to maintain capitalism in conditions of freedom.

By this time Keynes was the most famous economist in the world, made so by his superb style and the audacity of his ideas. But he had not ‘revolutionized’ economics, and he himself felt that his theoretical work was incomplete. The Great Depression of 1929–32, together with technical flaws in A Treatise on Money, took Keynes back to the theoretical drawing board. What now seemed to be needed was not an explanation of Britain’s ‘special problem’ of heavy unemployment, or even of the business cycle, but an explanation of how plant and labour could remain unused for long periods in a world in which wants were far from being satisfied. He felt this to be both economically and morally inefficient. He drew inspiration from the ‘first Cambridge economist’, Thomas Robert Malthus, from whom he got the phrase, and possibly the idea of, ‘effective demand’. From the autumn of 1931 to the summer of 1935, Keynes worked on a new book of theory, initially entitled ‘The Monetary Theory of Production’. He was helped not just by older economists like Ralph Hawtrey and Dennis Robertson, but by Roy Harrod and a ‘Cambridge Circus’ of young disciples headed by Richard Kahn, his ‘favourite pupil’. There was just one major pamphlet in these years, ‘The Means to Prosperity’, written in June in 1933. On a trip to the United States in 1934 to study the New Deal first-hand, he wrote: ‘Here, not in Moscow, is the economic laboratory of the world.’

In February 1936, Keynes published The General Theory of Employment, Interest and Money, in which he felt had finally cracked the riddle of unused resources. In this book, he sought to demonstrate both that ‘under-employment equilibrium’ is logically possible and how cheap money combined with an extensive ‘socialisation of investment’ could maintain full employment. These propositions divided the economics profession, since the core of the General Theory was Keynes’s rejection of the ‘classical’ thesis of an optimally self-adjusting economy. The publication of the General Theory marked the birth of a ‘Keynesian school’ of economics led by Richard Kahn and Joan Robinson at Cambridge, Roy Harrod and James Meade at Oxford, and Nicholas Kaldor and Abba Lerner at the London School of Economics. In the United States, the book supplied the younger generation of (mainly Harvard-trained) economists with a practical rationale for the New Deal. Keynes himself joined in the fierce controversies which his General Theory generated, even though he was severely incapacitated, from May 1937 to March 1939, with heart disease. As another European war, and with it the return to full employment, became increasingly likely, Keynes sought to win acceptance for his revolution by showing how the management of aggregate demand to avert depression could just as easily be used to control inflation in a war economy.

The upshot was his pamphlet How to Pay for the War (1940), which won the approval of his arch-critic Friedrich Hayek, and whose logic influenced Chancellor of the Exchequer Kingsley Wood’s war budget of 1941. Restored to a semblance of health by his doctor, Janos Plesch, Keynes himself returned to the Treasury in August 1940 as unpaid adviser to the chancellor of the exchequer and remained its dominating force for the rest of his life. Elevated to the House of Lords in 1942 as Baron Keynes of Tilton, his influence was felt in the Employment White Paper of 1944, which pledged the UK government to maintain a ‘high and stable level of employment’ after the war. In 1942, Keynes became chairman of the Council for the Encouragement of Music and the Arts (CEMA), a wartime innovation which, transformed into the Arts Council of Great Britain shortly before he died, inaugurated permanent state patronage of the arts.

The US demand that, in return for Lend-Lease, Britain scrap its imperial preference system after the war inspired Keynes to his last great constructive effort, his plan for an International Clearing Union (1941). This was designed to shift balance-of-payments adjustment from debtor to creditor countries, so as to avoid the externally generated deflationary shocks which had spread depression under the gold standard. The Bretton Woods Agreement of 1944, which set up a system of fixed, but adjustable, exchange rates and two new institutions, the International Monetary Fund and the International Bank for Reconstruction and Development, fell short of his hopes. The abrupt US cancellation of Lend-Lease in August 1945 led him to undertake the fifth of his six Treasury missions to the United States to secure an American grant or interest-free loan of $5 billion. Forced to accept a semi-commercial loan for an amount far less than he had requested, Keynes gave an eloquent defence of his policy in his last speech to the House of Lords on 7 December 1945.

On 21 April 1946, worn out by his labours, he suffered a fatal heart attack at Tilton, a little short of his sixty-third birthday. Lionel Robbins wrote to his widow that ‘he has given his life for his country, as surely as if he had fallen on the field of battle’. To his greatest intellectual opponent, Friedrich Hayek, ‘he was the one really great man I ever knew’. In an imposing memorial service at Westminster Abbey, Britain’s prime minister, Clement Attlee, headed a list of mourners drawn from all walks of Keynes’s life.

IIIAny account of Keynes’s contributions to economics must start with his distinctive theory of probability.

In his Treatise on Probability (1921), he sought to rescue the ordinary language (or ordinal) use of probability from the statistical (or cardinal) theory of probability. He put forward a logical theory of probability, of which the then dominant frequency theory was a special case. In ordinary life, we will often have enough evidence to say that something is more likely to happen than not, without having enough evidence to say it is three times as likely. Furthermore, Keynes distinguished between probability and uncertainty – situations in which people don’t have enough evidence to form any probabilities at all. Applied to economics, this was the distinction between risk and uncertainty. He accused the classical economic theories of his day of reducing ordinal to cardinal risk, and of excluding uncertainty as a factor in economic life. This led to the fallacy of misplaced precision: we assume we know the odds in many situations in which we have no odds at all. This was particularly applicable to financial markets. Keynes identified as a tacit axiom of the classical theory of the self-regulating economy that ‘at any given time facts and expectations were … given in a definite and calculable form’.3 This myopia prevented precautions being taken against catastrophe.

Keynes’s contributions to economic theory are contained in three books, A Tract on Monetary Reform (1923) (hereafter TMR), A Treatise on Money (1930) (heareafter TM) and The General Theory of Employment, Interest and Money (1936) (hereafter GT).

The first two are concerned with the causes of business fluctuations. In TMR business fluctuations are said to be mainly caused by changes in the price level. TM is the theory of a credit cycle, in which the cycle results from shifts in investment sentiment. GT is not concerned with fluctuations or cycles (though it has one chapter, chapter 22, called ‘Notes on the Trade Cycle’), but aims to show that a deficiency of aggregate demand can produce quasi-permanent stagnation. The duty of the monetary authority/government is different in the three cases. In the first it is to stabilize the price level; in the second it is to maintain equilibrium between saving and investment; in the third, it is to maintain full employment. There are theoretical shifts and technical improvements between the first and third books, but their preoccupations are the same: to find policy capable of maintaining continuous prosperity.

For Keynesians, GT is the important book, because it broke so radically from the mainstream assertion that a market economy had an automatic tendency towards full employment. Non-Keynesians prefer TMR. This is because they regard the ‘Keynesian’ innovations of GT as wrong.4 GT is also Keynes’s magnum opus in that in it he came nearest to fitting his intuitive understanding of things into a formal framework suitable for economists. TM has its defenders, though, notably Roy Harrod, John Hicks, Axel Leijonhufvud and Tim Congdon, who praise the subtlety of its monetary discussions.5 In some respects, its theory of deep cycles and sluggish recoveries is more ‘general’ than the General Theory.

Even non-Keynesians would admit that Keynes’s influence on the discipline was profound. But whereas Keynesians see it as inspirational, for non-Keynesians like Hayek it was ‘tragic’,6 pointing economics the wrong way. All agree that Keynes was a wonderful thinker and character; they disagree about the theoretical value of his work. Keynes’s ‘favourite pupil’, Richard Kahn, notes that ‘Keynes was far happier writing for a non-academic audience – whether members of the intelligent public, politicians or bankers. His popular and other non-academic writings were unlaboured, in contrast to the elements of strain and torture that entered into his academic writing. To secure conviction he relied on sincerity and commonsense.’7 The non-Keynesian Schumpeter sees him as ‘a man who would have conquered a place in history even if he had never done a stroke of specifically scientific work’.8

In GT Keynes sought to demonstrate that a market economy can oscillate indefinitely round a sub-normal level of activity. The concept of ‘under-employment equilibrium’ may be read as a stylized picture of the global economy in the 1930s. Much more radically, GT implied that this was not just a possible condition, but a normal condition. Economists before Keynes had been prepared to accept the possibility of ‘lapses from full employment’, due to this, that, or the other disturbance to ‘normal’ conditions. No one had hitherto asserted that market economies lapsed into full employment only in ‘moments of excitement’.

GT was by far the most influential of Keynes’s books. It led directly to the development of National Income and Expenditure Accounts, to enable governments to estimate the size of the ‘output’ gap – the gap between what the economy was producing and what it could produce at full employment (or, in a later refinement, what it could produce when it was growing to trend). Keynes also insisted that the aggregate demand and supply framework of GT could be used to work out how much spending needed to be withdrawn from an economy to prevent inflation if aggregate demand exceeded aggregate supply. How to Pay for the War (1940) was an explicit application of GT to an inflationary full employment economy. Governments used the aggregate supply and demand apparatus as the main framework for policy for thirty years during and after the war, and, in modified form, it is still the basis of contemporary macro-economic policy.

In principle, stabilization policy can be either monetary or fiscal, or some combination of both. In the 1920s, Keynes believed that monetary policy could and should be used to iron out fairly modest fluctuations in prices and output. In TM he advocated the offset of ‘open-market operations à outrance’ (a massive central bank injection of money) for an economy sliding down into a deep recession. In GT Keynes downplayed the role of monetary management. He did not deny the efficacy of cheap money in stimulating a depressed economy but warned that ‘if … we are tempted to assert that money is the drink which stimulates the system to activity, we must remind ourselves that there may be several slips between the cup and the lip’.9 He thought that interest rate changes were too uncertain in their effect on investment and worried that if interest rates were raised to check a boom it would be difficult to bring them down to check a slump, since investors would keep resources liquid in expectation of a rise. So he advocated a policy of permanently cheap money. This left fiscal policy as the main instrument for preventing both slumps and inflationary booms.

Keynes’s fiscal philosophy must be distinguished from Keynesian fiscal policy as understood and practised after his death. It was based on a sharp distinction between the government’s ‘ordinary’ or current-account budget and what he called the ‘capital’ budget. The government’s ordinary budget should be balanced, with a surplus earmarked for debt repayment in ‘normal’ times (the Victorian ‘golden rule’). It was the task of the capital budget to balance the ‘national accounts’. Keynes believed that a great deal of investment was already ‘socialised’, that is, subject to public policy even if it was technically private. As he put it in 1943: ‘If two-thirds or three-quarters of total investment is carried out or can be influenced by public or semi-public bodies, a long-term programme of a stable character should be capable of reducing the range of fluctuation to much narrower limits than formerly … If this is successful it should not be too difficult to offset small fluctuations by expediting or retarding some items in this long-term programme.’10

Finally, Keynes attached only minor importance to exchange-rate adjustments. His Clearing Union plan (1941) provided for fixed, but adjustable, rates, and this was a feature of the Bretton Woods Agreement (1944). Keynes’s attitude – like that of most economists of his day – was governed by price-elasticity pessimism. He preferred countries to use, if necessary, capital controls to protect their balance of payments in the framework of a monetary regime of fixed exchange rates, low tariffs and automatic creditor lending through international institutions.

IVKeynes was not an ivory-tower theorist. His theorizing was controlled by real-world events. His own investment experience enabled him to identify the ‘speculative’ motive for holding money; his sense of political fragility led him to concentrate on the economics of stabilization; his civil service experience enabled him to turn theories into workable plans. His economic theorizing was less directly, but still importantly, controlled by his ethical beliefs, particularly his conception of the good life and the conditions of just exchange.

There is much more to Keynes than his economic theory and policy. He reflected and wrote on the art of statesmanship (‘politicians have ears but no eyes’), on the ‘agenda’ of government in a modern society, and on the relationship between the state and the arts. He had an acute sense of character and place, and wrote some outstanding short biographies and essays. He loved literature, acquired an exceptional collection of paintings, sponsored English art and ballet and built the Cambridge Arts Theatre in 1936, in homage to both Cambridge and the dramatic arts. He was chairman-designate of the Arts Council of Great Britain when he died. He had an ethically based vision of the future in which ‘love of money’ would cease to be a driving force in human affairs, and thought that this condition might come about in a fairly short space of time.

Keynes wrote:

the master-economist must possess a rare combination of gifts. He must reach a high standard in several different directions and must combine talents not often found together. He must be mathematician, historian, statesman, philosopher – in some degree. He must understand symbols and speak in words. He must contemplate the particular in terms of the general, and touch abstract and concrete in the same flight of thought. He must study the present in the light of the past for the purposes of the future. No part of man’s nature or his institutions must be entirely outside his regard. He must be purposeful and disinterested in a simultaneous mood; as aloof and incorruptible as an artist, yet sometimes as near to earth as a politician.11

This is Keynes on his teacher Alfred Marshall. It has little to do with Marshall, but tells us a lot about how Keynes saw himself. In truth his ‘mixed training and divided nature’ gave him a much more vivid many-sidedness than that possessed by his teacher. In GT, he paid tribute to ‘the brave army of heretics … who, following their intuitions, have preferred to see the truth obscurely and imperfectly rather than to maintain error, reached indeed with clearness and consistency and by easy logic but on hypotheses inappropriate to the facts’.12 Keynes’s genius lay in his ability to convert heretical intuitions into a logic which satisfied, at least for a time, the formal requirements of economics. He brought the worlds of art and science together. No one else in economics has been able to do this. That is what enabled him to leave such a large mark on modern civilization and makes him today as fresh as he ever was.

There were gaps in Keynes’s equipment as an economist, unsurprising in someone who had only studied the subject for a couple of terms before he started teaching it. He relied heavily on students like Richard Kahn and Joan Robinson to fill these gaps. The marginalist revolution, which was the main innovation in economics in the late nineteenth century, never really got under his skin. He was not especially learned in economic history or the history of his own discipline, telling a student in the 1920s that ‘[w]hen he was old and no longer alert enough for difficult and exact analysis, he … would like to give his time, as a refuge and diversion … to … economic history and the history of economic thought’.13 He would revise his views in the 1930s, when he became keen to establish a lineage for his own economic heresy. He preferred the eighteenth century to the nineteenth and always treated ‘Victorian values’ ironically. By the late 1920s even his mathematics was rusty, and he had to get Kahn to check his equations.

After Keynes’s death, the economics profession discarded his intuitions and kept those pieces of his theory which could be justified in terms of its own formalism. Keynesians are now confined to fringes of economics departments or in adjacent fields of study. But it is from the heresies that post-crash economics will come, if it comes at all.

Readers are invited to read this selection to catch the flavour of Keynes’s intuitions about the matters in which he was involved and find out to what extent they correspond to their own.

VThe selections I have chosen represent a compromise between the claims of economics and the claims of understanding. Keynes wrote as well in economics as that subject allows, and even better. He found it hard to disguise the elevation and subtlety of his mind, the vivacity and wit of his prose. But economics is difficult and has to be done in a way which non-economists often find both repellent and inaccessible. So the selections present Keynes in two guises: that of the economist and that of the public intellectual who wrote and thought about the great issues of his day and about the meaning of life.

Any selector has to make judgements of relevance. I have chosen those writings of Keynes which, in my view, can stimulate thought in our world, as well as giving pleasure. Some things he wrote are simply dead and have not been included. Separate chapters treat Keynes as philosopher, social philosopher, economist, policy-maker and essayist. Strictly speaking, one cannot separate the elements of his thought in this way, and my method sometimes suffers from the practical disadvantage of placing different sections of his main books in chapters. The Economic Consequences of the Peace and A Tract on Monetary Reform suffer particularly from being spliced up in this way. The advantage, though, is that it enables the reader to identify the separate building blocks of Keynes’s thinking and appreciate the force of his wife’s observation that he was ‘more than an economist’. Most of chapter 3, ‘The Economist’, will be fully accessible only to the specialist, but even here, the non-specialist can catch glimpses of the ‘more’.

What gives his work its special flavour is not only its breadth but its style. Only Keynes’s stylistic panache could have invested concepts like ‘fallacy of composition’ and the ‘paradox of thrift’ with the force of common sense. The popular reception of the Keynesian Revolution was promoted by Keynes’s journalism. Much of this was published in the Nation and Athenaeum and then the New Statesman. Keynes also wrote for the ‘quality’ press, especially The Times, and popular newspapers like the Daily Mail, the Evening Standard and the Sunday Express, which would be highly unlikely to accept such contributions today. A favourite American outlet was the New Republic, and his articles were syndicated worldwide. His most quotable quotes are given at the end of the book.

Keynes’s greatness is to be seen not just in his ‘divided nature’, but in the quality of the practical judgement which resulted from it. In 1915–16 he argued for a compromise peace in the First World War. In 1919 he wanted a cancellation of inter-Allied debts and the drastic scaling-down of German reparations. In 1922 he proposed the cancellation of Tsarist debts and a loan to Russia to revive exports, so as to offer an alternative to Bolshevik economics. In 1923 he advocated the managed floating of the two main currencies, the dollar and the pound, and two years later he opposed Britain’s return to the gold standard at the pre-war sterling–dollar parity. He would have fought the Great Depression with a mixture of monetary expansion and public works. In 1939–40 he urged a method of financing the Second World War to avoid the hyper-inflation and collapse which followed the first; and in 1941 he proposed an International Clearing Union which could impose penalties on persistent current account surpluses.

A consistent thread runs through his attitude to statecraft which my hope is that the reader will be able to follow. One may call it prudence, or common sense. It consisted of trying to wrest the best results from the world as it is, and not sacrificing overmuch for a necessarily uncertain future. How much better we would have been if some of his suggestions had been adopted in his lifetime. The First World War would have had less destructive consequences; there would probably have been no Great Depression, no Hitler dictatorship, no Second World War. Bolshevism might have been nipped in the bud. Hundreds of millions fewer would have suffered and died. The developed capitalist world, reconstructed on a Keynesian basis after the second war, enjoyed twenty-five years of unparalleled growth, prosperity and stability. But he was no longer alive to plan for their continuation and amendment.

NOTES1 Excluding Essays in Persuasion (1931) and Essays in Biography (1933), which Keynes himself selected for publication. In 1944 there appeared in Zagreb J. M. Keynes, Problemi novca između dva rata – an odd place to be published and an even odder time. Fifty years later, in 1994, an updated version appeared: J. M. Keynes, Izabrana djela, with a slightly different selection, and including an essay by J. K. Galbraith. Donald Moggridge has edited a collection of Keynes’s broadcasts, Keynes on the Wireless (2010); Giorgio La Malfa has edited a selection of Keynes’s writings: J. M. Keynes, Sono un liberale? (2010), which includes essays taken from Essays in Persuasion (CW 9) and Essays in Biography (CW 10), and J. M. Keynes, Le mie prime convinzioni (2012), reproduces, in an Italian translation, Two Memoirs by J. M. Keynes, edited by D. Garnett (collected in CW 10), with a foreword by Giorgio La Malfa.

2 R. F. Kahn, The Making of Keynes’s General Theory (1984), pp. 50–51.

3 CW 14, p. 112.

4 For example, Milton Friedman, The Economist, 4 June 1983.

5 Roy Harrod, The Life of John Maynard Keynes (1951), pp. 403–4; John Hicks, ‘A Note on the Treatise’, in Critical Essays in Monetary Theory (1967), pp. 189–91; Axel Leijonhufvud, On Keynesian Economics and the Economics of Keynes (1968), pp. 16–26; Tim Congdon, Keynes, the Keynesians and Monetarism (2007), pp. 50–53.

6 F. A. Hayek, New Studies in Philosophy, Politics, Economics and the History of Ideas (1978), pp. 283, 7.

7 Kahn, Making of Keynes’s General Theory, p. 77.

8 Joseph Schumpeter, History of Economic Analysis (1954), p. 1170.

9 CW 7, p. 173.

10 CW 27, p. 322.

11 CW 10, pp. 173–4.

12 CW 7, p. 371.

13 H. M. Robertson, ‘J. M. Keynes and Cambridge in the 1920s’, South African Journal of Economics, vol. 51, issue 3 (1983); quoted in Robert Skidelsky, John Maynard Keynes, vol. 2 (1992), p. 676, fn. 18.

</section><section epub:type="preface" id="sec-preface005">

Bibliography

The Collected Writings of John Maynard Keynes, cited here as CW 1, 2, etc., is published in hard copy in thirty volumes, including bibliography and index, by Macmillan/Cambridge University Press for the Royal Economic Society, 1971–89. Volumes 15 to 18 were edited by Elizabeth Johnson, the remainder by Donald Moggridge. An electronic version is available at: http://universitypublishingonline.org/royaleconomicsociety/series_landing.jsf?seriesCode=CJMK&seriesTitle=The+Collected+Writings+of+John+Maynard+Keynes&productCode=&publisherCode=RES&sort=print_date_range. The following are the volumes from which excerpts or quotations have been made:

Vol. 2: The Economic Consequences of the Peace, 1971

Vol. 3: A Revision of the Treaty, 1971

Vol. 4: A Tract on Monetary Reform, 1971

Vol. 5: A Treatise on Money: The Pure Theory of Money, 1971

Vol. 6: A Treatise on Money: The Applied Theory of Money, 1971

Vol. 7: The General Theory of Employment, Interest and Money, 1973

Vol. 8: A Treatise on Probability, 1973

Vol. 9: Essays in Persuasion, 1972. Full text with additions

Vol. 10: Essays in Biography, 1972. Full text with additions

Vol. 13: The General Theory and After: Part 1: Preparation, 1973

Vol. 14: The General Theory and After: Part 2: Defence and Development, 1973

Vol. 17: Activities 1920–1922: Treaty Revision and Reconstruction, 1977

Vol. 21: Activities 1931–1939: World Crises and Policies in Britain and America, 1982

Vol. 22: Activities 1939–1945: Internal War Finance, 1978

Vol. 24: Activities 1944–1946: The Transition to Peace, 1979

Vol. 25: Activities 1940–1944: Shaping the Post-War World: The Clearing Union, 1980

Vol. 26: Activities 1941–1946: Shaping the Post-War World: Bretton Woods and Reparations, 1980

Vol. 27: Activities 1940–1946: Shaping the Post-War World: Employment and Commodities, 1980

Vol. 28: Social, Political and Literary Writings, 1982

The other main source drawn upon is Keynes Papers, King’s College Cambridge.

OTHER WORKSFor fuller Keynes bibliographies see Robert Skidelsky, John Maynard Keynes, 3 vols. (1983, 1992, 2000), and his abridged John Maynard Keynes 1883–1946, Economist, Philosopher, Statesman (2003); and D. E. Moggridge, Maynard Keynes: An Economist’s Biography (1992). The 2008 crisis has produced a spate of Keynes books, including Paul Davidson, The Keynes Solution (2009); Robert Skidelsky, Keynes: The Return of the Master (2010 edition); Robert and Edward Skidelsky, How Much Is Enough? (2012); and Peter Temin and David Vines, Keynes: Useful Economics for the World Economy (2014); as well as books critical of today’s mainstream economics and economic policies, not necessarily from a Keynesian standpoint. A small sample of works: John Cassidy, How Markets Fail: The Logic of Economic Calamities (2009); Roman Frydman and Michael D. Goldberg, Beyond Mechanical Markets: Asset Price Swings, Risk, and the Role of the State (2011); Felix Martin, Money: The Unauthorised Biography (2013); Philip Roscoe, I Spend Therefore I Am: The True Cost of Economics (2014); Tomas Sedlacek, Economics of Good and Evil (2011); George Akerlof and Robert Shiller, Animal Spirits: How Human Psychology Drives the Economy and Why It Matters for Global Capitalism (2009); Adair Turner, Economics After the Crisis (2012).

</section><section epub:type="preface" id="sec-preface006">

Keynes’s World, Main Characters

Below are short CVs of the main people cited in the texts. For fuller dramatis personae, see Robert Skidelsky, John Maynard Keynes, 3 vols. (1983, 1992, 2000), and his abridged John Maynard Keynes 1883–1946, Economist, Philosopher, Statesman (2003); and D. E. Moggridge, Maynard Keynes: An Economist’s Biography (1992).

Charles Addis (1861–1945), English banker, member of the Tuesday Club. Jousted with JMK over the return to the gold standard, but sympathized with his argument for delay.

Frederick Ashton (1904–1988), choreographer and ballet dancer, friend of Lydia Lopokova and JMK.

Herbert Henry Asquith (1852–1928), English Liberal politician, prime minister 1908–16. JMK got to know him well in the First World War. His break with Asquith in 1926 was the most important political rupture of his life.

Stanley Baldwin (1867–1947), English Conservative politician, prime minister 1923, 1924–9, 1935–7. JMK looked to him to bring about a modified socialism in line with English traditions.

Lord Beaverbrook, Maxwell Aitken (1879–1964), Canadian-born newspaper proprietor. His newspapers the Daily Express and the Evening Standard gave JMK a platform, especially in the campaign against the gold standard.

Clive Bell (1881–1964), art critic, member of the Bloomsbury group and friend of JMK.

Vanessa Bell, née Stephen (1879–1961), English painter, member of the Bloomsbury group and friend of JMK. He used to stay at Charleston, her rented farmhouse in Sussex.

William Beveridge (1879–1963), English statistician and administrator, author of the Beveridge Report, 1942, which established Britain’s welfare state. He and JMK were part of the Liberal mandarin circle, though they were not friends.

Ernest Bevin (1881–1951), English trade union leader and Labour politician. JMK educated him in economics on the Macmillan Committee in 1930–31 but failed to win his support for deferred pay in 1940.

John Bradbury (1872–1950), English civil servant, joint permanent secretary at the Treasury 1913–19. Treasury notes issued in the First World War were called ‘Bradburies’. JMK clashed with him about the gold standard and on the Macmillan Committee.

Robert Henry Brand (1878–1963), English banker and public servant. The meeting point between Keynes’s economics and City orthodoxy.

Edwin Cannan (1861–1935), English economist, professor of political economy 1907–26. An old-fashioned QTM man.

Neville Chamberlain (1869–1940), English Conservative politician, chancellor of the exchequer 1932–7, prime minister 1937–40. His policy of balanced budgets in the 1930s enraged JMK. JMK shared his unwillingness to fight Hitler, but not his eagerness to reach an agreement with him.

Georgi Vasilevich Chicherin (1872–1936), Soviet diplomat, whom JMK met at the Genoa Conference in 1922. His old-world courtesy gave spurious respectability to Soviet aims.

Winston Spencer Churchill (1874–1965), English politician and author, chancellor of the exchequer 1924–9, prime minister 1940–45, 1951–5. JMK attacked Churchill’s decision to put Britain back on the gold standard in 1925, but Churchill proposed his election to the Other Club in 1927, and there was respect, and even affection, between the two men.

Colin Clark (1905–89), Australian statistician. His pioneering work on national income statistics underpinned JMK’s How to Pay for the War (1940). Keynes thought he was the ‘only economic statistician I have met who seems to me to be quite first-rate’.

Georges Clemenceau (1841–1929), French politician, prime minister of France 1917–19. JMK encountered him at the Paris Peace Conference in 1919.

J. R. Commons (1862–1945), American institutionalist economist, professor of economics, Wisconsin University, 1904–34. He influenced JMK (see excerpt 10).

Leo Crowley (1889–1972), American businessman of Irish descent, head of the Foreign Economic Administration 1943–45. Frequent butt of JMK’s derision. His face reminded JMK of ‘the buttocks of a baboon’. This inspired the ‘BABOON’ codename for British telegrams from the Treasury during the Washington loan negotiations of 1945 (see Robert Skidelsky, John Maynard Keynes, vol. 3 (2000), p. 410).

Charles Gates Dawes (1865–1951), American businessman and banker. Author of the Dawes Plan (1924) for settling German reparations.

Geoffrey Dawson (1874–1944), English journalist, editor of The Times 1923–44. The Times gave JMK a platform for several columns in the 1930s, including ‘Paying for the War’ in November 1939.

Major Clifford Hugh Douglas (1879–1952), engineer turned economist. The most famous ‘crank’ of the interwar years, his A + B theorem inspired a passionate political following in the farming communities of Canada, Australia and New Zealand by promising a cure for the deflation of credit.

John Thomas Dunlop (1914–2003), American economist. His article ‘The Movement of Real and Money Wage Rates’, Economic Journal, September 1938, attracted a reply from JMK.

Wilfrid Eady (1890–1962), British Treasury official 1942–52, opposed JMK’s negotiating strategy for the American loan of 1945.

Marriner Eccles (1890–1977), American banker from Utah.

Albert Einstein (1879–1955), German-born physicist, Nobel laureate, a great cultural influence on JMK’s generation. The title of GT was consciously modelled on Einstein’s distinction between the ‘special’ (Newtonian) and the ‘general’ theory of relativity.

T. S. Eliot (1888–1965), American-born poet and High Anglican. Partly under Eliot’s influence, JMK came to see his employment theory as a secular application of Christian social doctrine.

Irving Fisher (1867–1947), American economist, professor of political and social science at Yale 1898–1935. Founder of the modern quantity theory of money, advocate of the compensated dollar.

Sigmund Freud (1856–1939), Austrian-born founder of psychoanalysis. JMK was influenced by his psychological theory of ‘love of money’.

Milton Friedman (1912–2006), American economist. He ‘restated’ the QTM and started the anti-Keynesian movement known as ‘monetarism’.

David (‘Bunny’) Garnett (1892–1981), English writer, friend of JMK, member of the Bloomsbury group.

Silvio Gesell (1862–1930), German-French merchant and monetary heretic, who lived in Argentina and Switzerland. His proposal for stamped money (endorsed by Irving Fisher) provided for banknotes to retain their value only if they were stamped each month, with the stamp being bought at the post office. It was intended as a disincentive to hoarding and in concept is similar to JMK’s proposal, in his Clearing Union plan, to tax persistent surpluses on current accounts.

Duncan Grant (1885–1978), English painter, member of the Bloomsbury group, friend and sometime lover of JMK.

Alvin Hansen (1887–1975), American economist. An early convert to JMK’s GT, he tirelessly promoted Keynesian economics in the USA, especially in the form of ‘secular stagnation’.

Roy Forbes Harrod (1900–1978), English economist, student (i.e. fellow) of Christ Church, Oxford 1924–67. Wrote the authorized biography of JMK, The Life of John Maynard Keynes, 1951. Chiefly known for the Harrod–Domar model of economic development.

Friedrich A. Hayek (1899–1992), Austrian-born economist and philosopher, JMK’s most formidable critic. See Bruce Caldwell, Hayek’s Challenge: An Intellectual Biography of F. A. Hayek (2004).

Hubert Henderson (1890–1952), British economist and long-term collaborator of JMK. They fell out over policies for dealing with the Great Depression, and Henderson never accepted JMK’s GT.

John Atkinson Hobson (1858–1940), British economist and journalist, best known for his critique of imperialism, which influenced Lenin, and for his doctrine of under-consumption. He failed to get a university job, remarking in his Confessions of an Economic Heretic, ‘I hardly realized that in appearing to question the virtue of unlimited thrift I had committed the unpardonable sin.’

Richard Hopkins (1880–1955), leading Treasury official in JMK’s time, who brought JMK into the Treasury in 1940. JMK had great respect and affection for ‘Hoppy’, who in turn was shifted from his pre-war monetary and fiscal orthodoxies.

Richard Ferdinand Kahn (1905–89), British economist. His multiplier theory was published as ‘The Relation of Home Investment to Unemployment’ in the Economic Journal, June 1931.

Florence Ada Keynes (1861–1958) and John Neville Keynes (1852–1949), JMK’s parents. Geoffrey Keynes (1887–1982), a surgeon, was his younger brother, and Margaret Hill (1885–1970), his younger sister.

D. H. Lawrence (1885–1930), English writer. Lawrence’s attack on Bloomsbury prompted JMK’s ‘My Early Beliefs’ (see excerpt 6).

Abba Lerner (1903–82), Russian-born American economist, author of the theory of ‘functional finance’.

David Lloyd George (1863–1945), British Liberal politician, prime minister 1916–22. JMK quarrelled with him over the Treaty of Versailles, but they were reconciled in the late 1920s (see excerpt 28).

Lydia Lopokova (1892–1981), Russian ballerina, married Keynes 1925.

James Ramsay MacDonald (1866–1937), British Labour politician, prime minister 1924, 1929–35. Used JMK as an adviser after 1929, but was too pessimistic to take his advice.

Reginald McKenna (1863–1943), British Liberal politician and banker. Chancellor of the exchequer 1915–16. JMK served under him at the Treasury, and they remained friends and political allies.

Alfred Marshall (1842–1924), English economist, professor of political economy, Cambridge University, 1883–1907. JMK’s economics teacher and foremost economist of his age. His hugely influential Principles of Political Economy was published in 1890. Sceptics of JMK’s claim to originality would say ‘It’s all in Marshall.’

James E. Meade (1907–95), English economist, friend and admirer of JMK. Served in the Economic Section of the War Cabinet.

Carl Melchior (1871–1933), German banker, friend of JMK. Excerpt 40 is from JMK’s memoir of him.

G. E. Moore (1873–1958), fellow of Trinity College, Cambridge 1894–1904, professor of philosophy, Cambridge 1925–39. Author of Principia Ethica, 1903.

Ottoline Morrell (1873–1938), pre-1914 Bloomsbury hostess. Her country house in Garsington, Oxfordshire, provided a refuge for pacifists in the war.

Arthur Cecil Pigou (1877–1959), British economist, colleague of JMK at King’s College, Cambridge, professor of political economy at Cambridge 1908–48. One of the founders of welfare economics.

Frank Ramsey (1903–30), English mathematician and philosopher, fellow of King’s College, Cambridge 1924–30. Friend of JMK, but critical of his theory of probability.

Lionel Robbins (1898–1984), British economist. Defended free trade and the policy of cutting spending in a slump against JMK. But he was a staunch ally of JMK in pushing through the Bretton Woods agreement and the American loan. In his autobiography, Autobiography of an Economist (1971), he partly retracted his opposition to JMK but nevertheless considered that economics as a study of ‘remoter effects’ was still a better guide to policy than the ‘gay reminder’ that ‘in the long run we are all dead’.

Dennis Holme Robertson (1890–1963), English economist. JMK’s main intellectual stimulus in the 1920s, but rejected JMK’s ‘revolution’ in the 1930s, with bad effects on their personal relations.

Edward Austin Robinson (1897–1993), British Cambridge economist.

Joan Robinson (1903–83), British Cambridge economist, wife of Austin Robinson, author of The Economics of Imperfect Competition (1933) and one of the most able expositors (and simplifiers) of JMK’s ideas. She said: ‘As I never learnt mathematics, I have had to think.’

Franklin Delano Roosevelt (1882–1945), American politician, president of the USA 1933–45. JMK put his hopes in FDR for a democratic escape from the Depression, and later to help Britain generously in the Second World War. He had four meetings with him and was, as most were, charmed by him.

Bertrand Russell (1872–1970), English philosopher. His Principles of Mathematics (1903) influenced JMK’s theory of probability.

Joseph Alois Schumpeter (1883–1950), Austrian-born American economist, professor of economics at Harvard 1932–50, theorist of ‘creative destruction’.

Henry Sidgwick (1838–1900), Cambridge philosopher, friend of the Keynes family in Cambridge, Knightbridge professor of moral philosophy, Cambridge University, 1883–1900.

Philip Snowden (1864–1937), English Labour politician. Chancellor of the exchequer 1929–31.

Arthur Spiethoff (1873–1957), German institutional and business-cycle economist. In 1933 JMK contributed an important article, ‘A Monetary Theory of Production’, to his Festschrift (excerpt 19).

Oliver Sprague (1873–1953), American-born economist, economic adviser to the Bank of England 1930–33.

Piero Sraffa (1898–1983), Italian-born economist, Cambridge University lecturer in economics 1927–31. So great was his horror of teaching that Keynes had to invent for him the job of editing Ricardo’s papers to keep him in Cambridge.

Lytton Strachey (1880–1932), English biographer and literary critic, member of the Bloomsbury group, a close friend of JMK and a mentor in matters of taste.

Jan Tinbergen (1903–94), Dutch statistician, ‘father of econometrics’.

Knut Wicksell (1851–1926), Swedish economist, founder of the Stockholm school and a key figure in modern economics. Wicksell led the break from the quantity theory of money, which JMK followed. In TM, JMK adopted his ‘natural rate of interest’ theory but later discarded it as it suggested a unique position of equilibrium.

Ludwig Wittgenstein (1889–1951), Austrian-born philosopher, fellow of Trinity College, Cambridge 1930–36, professor of philosophy, Cambridge University 1939–47. ‘God has arrived. I met him on the 5.15 train,’ JMK wrote to his wife when Wittgenstein came to stay with him in Cambridge in 1929.

Virginia Woolf (1882–1941), English writer, member of the Bloomsbury group, friend of JMK. With her husband, Leonard Woolf (1880–1963), she started the Hogarth Press, which published Keynes’s essays and pamphlets in the 1920s and 1930s.

</section><section epub:type="chapter" id="sec-chapter001">

One

------------------------------

THE PHILOSOPHER

‘Philosophy provided the foundation of Keynes’s life. It came before economics; and the philosophy of ends came before the philosophy of means.’

Robert Skidelsky, John Maynard Keynes, vol. 1 (1983), p. 133

Five elements of Keynes’s philosophy, acquired early in life, had a profound influence on his economics: his intuitionism; the primacy of ethics; the relationship between ethics and morals; the doctrine of organic unity; and the logical theory of probability. Keynes owed the first four directly to the Cambridge philosopher G. E. Moore; his probability theory developed from a disagreement with Moore.

</section><section epub:type="chapter" id="sec-chapter001-01">

1

‘Ethics in Relation to Conduct’ (1904)

[In October 1902, the nineteen-year-old Keynes entered King’s College, Cambridge to study mathematics. In February 1903 he was elected to the Cambridge Conversazione Society, or Apostles, an exclusive student club which met on Saturday evenings to discuss papers written by members or former members. Its intellectual atmosphere when Keynes joined was dominated by the views and character of G. E. Moore. In October 1903 came the publication of Moore’s Principia Ethica. Its influence on the young Keynes was instant, profound and permanent.

At the heart of Principia was the notion of the indefinability of good, and the distinction between ‘ethics’ and ‘morals’. We knew what was good through moral intuition. The primary ethical question is ‘What sort of things ought to exist for their own sake?’ The moral questions, ‘What ought I to do?’, ‘How ought I to behave?’, must be answered by reference to the primary question, taking into account the probable consequences of action. Moore’s doctrine is both startling and austere:

By far the most valuable things, which we know or can imagine, are certain states of consciousness, which may be roughly described as the pleasures of human intercourse and the enjoyment of beautiful objects … it is only for the sake of these things – in order that as much of them as possible may at some time exist – that any one can be justified in performing any public or private duty … it is they … that form the rational ultimate end of human action and the sole criterion of social progress.1

Keynes cut his philosophic teeth on Moore in a paper on ‘Ethics in Relation to Conduct’, read to the Apostles on 23 January 1904. It survives only in manuscript form, without page numbers. It is filed in KP: UA/19/2. For its dating, see Robert Skidelsky, John Maynard Keynes, vol. 2 (1992), p. 655, fn. 7. In this paper, he criticizes Moore’s theory of probability.

Keynes interprets Moore as arguing that probability is frequency: the ratio of times something happens to times it might happen. Since we lacked frequencies – and therefore probabilities – of the effects of our actions over time, we should, Moore argues, follow the generally accepted rules of conduct, what is now called ‘rule utilitarianism’. Keynes agreed with Moore that we lacked frequencies over time, but argued against him that our actions should aim to produce the greatest good in the circumstances of the case – what is now called ‘act utilitarianism’. To support his position Keynes advanced a modified form of the ‘principle of indifference’. This held that alternatives are equally probable if, given our evidence, there is no reason to choose between them. Its main purpose was to neutralize the effect of the unknown. Keynes’s subsequent book, A Treatise on Probability, was an attack on the frequency theory of probability. His rejection of the identification of probability with frequency determined his views on the limits of mathematical forecasting in economics.]

On the interpretation of probability which I have supported in this paper, even if we have no knowledge whatever as to the result of our actions … after a lapse of (say) 100 years, it is still possible for us to make such a statement as ‘x is probably right’ without falsehood.

For suppose that we have evidence to show that an action will produce more good than not in the next year and have no reason for supposing either that it will produce more good than evil or the reverse after the end of that period [my italics] if, in fact, we are in complete ignorance as to all events subsequent to the end of the year, – in that case we have, in my opinion, more evidence to support the view that x is right than to support the contrary and hence we are justified in saying ‘x is probably right’.

</section><section epub:type="chapter" id="sec-chapter001-02">

2

‘The Political Doctrines of Edmund Burke’ (1904)

[This eighty-six-page unpublished typed essay is filed at KP: UA/20/315. Dated November 1904, it was written the same year as ‘Ethics in Relation to Conduct’ above and won the University Members Prize for English Essay. In it, Keynes invokes the principle of indifference to support the political doctrine of prudence. Burke’s doctrine of prudence had a profound effect on Keynes’s theory of economic policy and, more generally, his theory of statesmanship. It is reflected in his most celebrated remark: ‘In the long run we are all dead.’]

In regard to the remaining point – [Burke’s] timidity in introducing present evil for the sake of future benefits – he is emphasising a principle that is often in need of such emphasis. Our power of prediction is so slight, our knowledge of remote consequences so uncertain, that it is seldom wise to sacrifice a present benefit for a doubtful advantage in the future. Burke ever held, and held rightly, that it can seldom be right to sacrifice [14] the well-being of a nation for a generation, to plunge whole communities in distress, or to destroy a beneficent institution for the sake of a supposed millennium in the comparatively remote future. We can never know enough to make the chance worth taking, and the fact that cataclysms in the past have sometimes inaugurated lasting benefits is no argument for cataclysms in general. These fellows, says Burke, have ‘glorified in making a Revolution, as if revolutions were good things in themselves’.

He is continually insisting that it is the paramount duty of governments and of politicians to secure the well-being of the community under their care in the present, and not to run risks overmuch for the future; it is not their function, because they are not competent to perform it. ‘In their political arrangements, men have no right to put the well-being of the present generation wholly out of the question. Perhaps the only moral trust with any certainty in our hands is the care of our own time … If ever we ought to be economists even to parsimony it is in the voluntary production of evil.’

In addition to the risk involved in any violent method of progress, there is this further consideration that is often in need of emphasis:– it is not sufficient that the state of affairs which we seek to promote should be better than the state which preceded it; it must be sufficiently better to make up for the evils of the transition. Burke … presses this doctrine further than it will bear, but there is no small element of truth in it and no [15] small tendency in revolutionary reformers to overlook it.

…

It is on this principle that Burke’s attitude towards war is mainly based; there are occasions, he maintains, when it is necessary as a means, and never can such occasions altogether cease, but it is a means that brings innumerable evils in its train. It is not sufficient that a nation’s legal claim should have been infringed. Only great causes justify it; with much prudence, [16] reverence, and calculation must it be approached.

</section><section epub:type="chapter" id="sec-chapter001-03">

3

The Adding-Up Problem (1904)

[Keynes subscribed to Moore’s doctrine of organic unity, a surviving vestige of Hegelianism in his thinking. This is the view that a whole consists of interdependent parts, so that its value – as in a work of art – can be greater or smaller than the sum of those parts. Keynes uses this is as an argument against trying to sum goodness by adding up individual goods. This is in line with his rejection of methodological individualism as a generally valid method of analysis in economics. The macro-economy is not equal to the sum of individual choices. Key ideas in Keynes’s economics like the ‘fallacy of composition’ and the ‘paradox of thrift’ originate in the doctrine of organic unity. Individual decisions, rational in isolation, can have effects greater or lesser than intended because of their reactions on others.2 This imparts inescapable uncertainty to many outcomes of interest to the individual decision-maker.

In ‘Ethics in Relation to Conduct’ he writes:]

… the unpopularity of the principle of organic unities shows very clearly how great is the danger of the assumption of unproved additive formulas.

The fallacy, of which ignorance of organic unity is a particular instance, may perhaps be mathematically represented thus:

suppose f(x) is the goodness of x and f(y) is the goodness of y. It is then assumed that the goodness of x and y together is f(x) + f(y)

when it is clearly f(x + y)

and only in special cases will it be true that f(x + y) = f(x) + f(y).

</section><section epub:type="chapter" id="sec-chapter001-04">

4

‘The Principles of Probability’ (1908)

[This excerpt is from the (unpublished) dissertation Keynes submitted for a prize fellowship at King’s College, Cambridge, in 1908. It is filed under KP: 20D. He was unsuccessful that year but was elected to a prize fellowship a year later. In this thesis, Keynes sought to extend the field of logical argument to include those cases in which the conclusion is partly, but not wholly, entailed by the premiss. This allows for the play of logical intuitionism: we intuit that the conclusion follows from the premiss, even though it lacks the formal quality of the syllogism. His aim in this was to align probability to ordinary discourse, ‘through which practical conclusions of action are most often reached’. This view would lead Keynes to attack the exaggerated use of mathematical formalism in economics. The following extract is taken from the first chapter of his dissertation.]

In the ordinary course of thought and argument we are constantly asserting that the truth of one statement, while not proving another, is nevertheless some ground for believing the second. We assert that with the evidence at our command, we ought to hold such and such a belief. We expressly say we have rational grounds for assertions which are, in the usual logical sense, unproved. We allow, in fact, that statements may be unproved, without for that reason being unfounded. Nor does reflection show that it is information of purely psychological import which we wish to convey when we use such expressions as these … We are in fact claiming to cognize correctly a logical connexion between one set of propositions which we call our evidence and which we take to be true, and another set which we call our conclusions and to which we attach more or less weight according to the grounds supplied by the first. We recognize that objectively evidence can be real evidence and yet not conclusive evidence … I do not think I am straining the use of words in speaking of this as the probability relation or the [3] relation of probability. The idea of a premiss’s having some weight to establish a conclusion, of its lying somewhere between cogency and irrelevancy is altogether foreign to a logic in which the premiss must either prove or not prove the alleged conclusion. This opinion is, from the nature of the case, incapable of positive proof. The notion presents itself to the mind, I feel, as something independent and unique.

…

Yet that ‘probability’ is, in the strict sense, indefinable, need not trouble us much; it is a characteristic which it shares with many [8] of our most necessary and fundamental ideas.

</section><section epub:type="chapter" id="sec-chapter001-05">

5

CW 8, A Treatise on Probability (1921)

[The Treatise was finished in 1914, following the addition of a section on ‘The Foundations of Statistical Inference’, but the war delayed its publication. In the following excerpt, from chapter 1, Keynes states the logical concept of probability.]

The terms certain and probable describe the various degrees of rational belief about a proposition which different amounts of knowledge authorise us to entertain. All propositions are true or false, but the knowledge we have of them depends on our circumstances; and while it is often convenient to speak of [3] propositions as certain or probable, this expresses strictly a relationship in which they stand to a corpus of knowledge, actual or hypothetical, and not a characteristic of the propositions in themselves. A proposition is capable at the same time of varying degrees of this relationship, depending upon the knowledge to which it is related, so that it is without significance to call a proposition probable unless we specify the knowledge to which we are relating it.

To this extent, therefore, probability may be called subjective. But in the sense important to logic, probability is not subjective. It is not, that is to say, subject to human caprice. A proposition is not probable because we think it so. When once the facts are given which determine our knowledge, what is probable or improbable in these circumstances has been fixed objectively, and is independent of our opinion. The theory of probability is logical, therefore, because it is concerned with the degree of belief which it is rational to entertain in given conditions, and not merely with the actual beliefs of particular individuals, which may or may not be rational.

Given the body of direct knowledge which constitutes our ultimate premisses, this theory tells us what further rational beliefs, certain or probable, can be derived by valid argument from our direct knowledge. This involves purely logical relations between the propositions which embody our direct knowledge and the propositions about which we seek indirect knowledge. What particular propositions we select as the premisses of our argument naturally depends on subjective factors peculiar to ourselves; but the relations, in which other propositions stand to these, and which entitle us to probable beliefs are objective and logical.

Let our premisses consist of any set of propositions h, and our conclusion consist of any set of propositions a, then, if a knowledge of h justifies a rational belief in a of degree α, we can say [4] that there is a probability-relation of degree α between a and h.*

[The most striking feature of Keynes’s theory was the large class of non-numerical probabilities it contained. Keynes’s universe of probability contained three types of probability: numerical (where the probability lies on a line between 0 and 1); non-numerical (where x is more/less likely to happen than y); and unknown (due to lack of logical insight or in presence of non-comparable arguments). The first two divisions correspond to cardinal and ordinal rankings. Keynes attacked the tendency to convert non-numerical probabilities into numerical ones. This would later become standard in both probability and economic theory through the application of Bayes’ Theorem, by which subjective bets are converted into objective frequencies through repeated instances. Agents in contemporary economics are modelled as having ‘mathematical expectations’, that is, as being able to calculate possible benefits multiplied by the probability of attaining them into an infinite future.

The question of which parts of unknown probabilities are unknown because of the complexity of the interacting parts of the social system, which defies our present power of computation, or are ontologically unknowable, because ‘we create our own future’, is currently debated in the behavioural sciences. The doctrine of organic unity would have inclined Keynes to the latter view. In this extract, it is only possible to give a flavour of his style and method of argument.]

There seems to me to be extremely strong reasons for [doubting] whether any two probabilities are in every case theoretically capable of comparison in terms of number. Let us examine a few more cases.

…

[We] may sometimes have some reason for supposing that one object belongs to a certain category if it has points of similarity to other known members of the category (e.g. if we are considering whether a certain picture should be ascribed to a certain painter), and the greater the similarity the greater the probability of our conclusion. But we cannot in these cases measure the increase; we can say that the presence of certain peculiar marks in a picture increases the probability that the artist of whom these marks are known to be characteristic painted it, but we cannot say that the presence of these marks makes it two or three or any other number of times more probable than it would have been without them. We can say that one thing is more like a second object than it is like a third; but there will very seldom be any meaning in saying that it is twice as like. Probability is, [30] so far as measurement is concerned, closely analogous to similarity.

…

[Keynes gives an example where it may not be possible even to rank probabilities.]

This leads up to a contention, which I have heard supported, that, although not all measurements and not all comparisons of probability are within our power, yet we can say in the case of every argument whether it is more or less likely than not. Is our expectation of rain, when we start out for a walk, always more likely than not, or less likely than not, or as likely as not? I am prepared to argue that on some occasions none of these alternatives hold, and that it be an arbitrary matter to decide for or against the umbrella. If the barometer is high, but the clouds are black, it is not always rational that one should prevail over the other in our minds, or even that we should balance them, – though it will be rational to allow caprice to determine us and [32] waste no time on the debate.

…

I maintain, then, in what follows, that there are some pairs of probabilities between the members of which no comparison of magnitude is possible; that we can say, nevertheless, of some pairs of relations of probability that one is greater and the other less, although it is not possible to measure the difference between them; and that in a very special type of case … a meaning can [36-7] be given to a numerical comparison of magnitude. [The first case becomes the ‘radical uncertainty’ of GT.]

[In chapter 6, Keynes introduces the notion of ‘weight’ of evidence as determining not the magnitude of the probability but the amount of confidence it is rational to have in making a judgement of probability; and in chapter 26, ‘The Application of Probability to Conduct’, the notion of ‘moral risk’: the idea that a smaller good more certain of attainment is better than a greater good whose attainment is less certain. Both principles are independent of probability, but necessary for a rational judgement on conduct. ‘At any rate,’ Keynes writes on p. 347, ‘there seems … a good deal to be said for the conclusion that, other things being equal, that course of action is preferable, which involves least risk and about the results of which we have the most complete knowledge’. He doubted (p. 83) that the theory of ‘evidential weight’ had ‘much practical significance’; but he takes it up in his discussion of investment behaviour in chapter 12 of GT (see below, p. 204).]3

</section><section epub:type="chapter" id="sec-chapter001-06">

6

CW 10, ‘My Early Beliefs’ (1938)

[‘My Early Beliefs’ was a paper Keynes read, at the age of fifty-five, to the Memoir Club, a group of friends consisting of older and younger members of the Bloomsbury group, at his country house, Tilton, on 9 September 1938. It was published posthumously in Two Memoirs, with an introduction by David Garnett, in 1949. (For the second of the two memoirs, see excerpt 40.)

Keynes set out to defend himself – and his Bloomsbury friends – from D. H. Lawrence’s charge that they were frivolous. He aimed to show that his ‘early beliefs’ may have been utopian, but they were not lightly held. They were ‘still my religion under the surface’.]

I went up to Cambridge at Michaelmas 1902, and Moore’s Principia Ethica came out at the end of my first year. I have never heard of the present generation having read it. But, of course, its effect on us, and the talk which preceded and followed it, dominated, and perhaps still dominate, everything else. We were at an age when our beliefs influenced our behaviour, a characteristic of the young which it is easy for the middle-aged to forget, and the habits of feeling formed then still persist in a recognisable degree. It is those habits of feeling, influencing the majority of us, which make this Club a collectivity [435] and separate us from the rest.

…

Now what we got from Moore was by no means entirely what he offered us. He had one foot on the threshold of the new heaven, but the other foot in Sidgwick and the Benthamite calculus and the general rules of correct behaviour. There was one chapter in the Principia of which we took not the slightest notice. We accepted Moore’s religion, so to speak, and discarded his morals. Indeed, in our opinion, one of the greatest advantages of his religion, was that it made morals unnecessary – meaning by ‘religion’ one’s attitude towards oneself and the ultimate and by ‘morals’ one’s attitude towards the outside world and the intermediate. To the consequences of having a religion and no morals I return later.