Chapter 1

◼

Work Well Under Pressure

“Wanted. Trainee Futures Traders,” ran the small ad in the Tuesday edition of the Evening Standard newspaper. “Applications are invited from graduates who can demonstrate the following skills: highly motivated; analytical approach; disciplined; goal orientated; work well under pressure.”

Nav was two years out of university when he sent his CV to Independent Derivatives Traders at the start of 2003. After graduating he’d spent a miserable slog doing telesales for Dial-a-Phone, then taken an admin job on the foreign exchange desk at Bank of America, where the closest he got to trading was booking trades for the posh folks on the floor. By the time IDT invited him to Weybridge in Surrey for an interview, he was unemployed and restless.

Nav might not have known it yet, but he was uniquely well suited to the job. When he was three years old he stumbled across a book of times tables and learned them by heart. By the time he got to school he could multiply longer numbers in his head. It wasn’t that the answers appeared, fully formed, when he saw a question. The trick lay in his memory. Where other children scrawled their workings on a piece of paper, Nav could hold each step, naturally and easily, in his brain. In high school, the problems got harder but he found he still didn’t need a calculator. Math and science were his best subjects, but he picked up As and Bs across the board without much effort. Heston Community School was no place for teacher’s pets, and Nav made sure nobody mistook him for one. He played practical jokes, was cheeky, and rarely showed up to class on time. Beverley Fielder-Rowe, his form tutor, recalled “a very likeable young man, very intelligent” who was “full of fun.” A classmate described him as a “prankster” who “got away with things.”

Schoolwork came easily to Nav, but his abiding love was soccer; he and his friends played constantly. In the summer, they cycled to the park in replica kits and kicked a ball until it got dark, stopping only to refuel at the fish-and-chip shop. Nav always insisted he play striker, the glory position, stalking the opposition goal and dispatching opportunities with icy precision. Later on, his attention turned to computer games, particularly the soccer game FIFA. Every time a new edition came out, he devoted hours to perfecting the new moves, eventually ranking in the top one thousand out of three million players globally. Unusually, Nav didn’t support an English team. Being part of a community was less important to him than who was the best, and he followed Barcelona.

In 1998, Nav had temporarily left home to attend Brunel, a mid-tier university a few miles from Hounslow, where he studied computer science and math. Like many students, Nav and his friends were broke. But one of their housemates always seemed to have cash. One day, Nav asked him how he could afford such expensive clothes. “Trading,” came the response. At the time, the dotcom bubble was in full swing, and Nav’s friend had deposited his student loan into a brokerage account and was now funding his studies by buying and selling tech stocks. How hard could it be, thought Nav. He started devouring anything trading-related he could, scouring the Internet for stock tips and plowing through textbooks on financial theory then opening an account of his own and placing some tentative trades.

IDT was based above a Waitrose supermarket. To gain entry, visitors had to walk around the back of the store and up a staircase. Inside were two main rooms, the larger of which, the “trading floor,” had around a dozen desks containing computers with connections to the world’s major commodities exchanges. On first glance, it didn’t scream high finance: the décor was drab, the equipment was dated, and it overlooked a car park. Weybridge, a well-heeled, sleepy town surrounded by golf courses and car showrooms, was also an odd location for a trading firm. Forty-five minutes by train from the skyscrapers of the City of London, the capital’s historic financial district, it was literally and figuratively miles from the action.

IDT was one of a burgeoning number of arcades or “prop shops” sprouting up in Britain and the United States. The business model was straightforward and, for a while at least, highly lucrative. IDT would take on a bunch of wannabe traders and teach them the skills they needed to succeed in the markets. Those who thrived were backed with steadily larger sums, while those who failed were cut. Any profits the recruits made after paying a monthly desk fee of around $1,700 were split, with newbies retaining 50 percent and the most successful as much as 90 percent. IDT also creamed off a small sum on each trade, or “round-trip,” its traders placed, which quickly added up. The arrangement meant it didn’t matter if everyone in the stable was making money as long as they were all buying and selling and there were at least some big winners. As the owner of a rival arcade put it: “During the gold rush, it was usually the ones selling the spades who got rich.”

For a generation of ambitious graduates brought up watching Wall Street and Trading Places but lacking the grades or connections to land a job at JPMorgan, the opportunity was irresistible. The best day traders, they were told by IDT in a rousing speech on arrival, could make their own hours, wear flip-flops to work, and still pull in footballer money. All they had to do was predict whether the market would go up or down more often than they were wrong, and they would be rich and free. The reality, of course, was that it was very difficult to consistently beat the market after costs, particularly when you were so far from the flow of information.

The selection process for Nav and his fellow interviewees was in three parts. First, candidates were given the McQuaig Mental Agility Test, a multiple-choice psychometric exam testing pattern recognition and verbal reasoning. This was followed by a one-on-one session in which they were asked to quickly multiply two- and three-digit numbers in their heads. Those who made it through were invited back a few days later for a two-hour interview, where they were questioned on how they would react to various hypothetical scenarios. IDT was looking for candidates who demonstrated high levels of dominance, analytical ability, sociability, and risk taking, as well as a passion for the markets.

The panel consisted of IDT’s founder, Paolo Rossi, his brother Marco, their junior partner, Dan Goldberg, plus whoever ran the firm’s training at the time. They were like a dysfunctional family unit. Paolo, the patriarch, was a short, taciturn alpha male who’d made a fortune in London’s do-or-die futures pits in the eighties and nineties. At thirty-seven, he owned a mansion in Weybridge on the same gated estate as Elton John. He wore tailored jackets over turtlenecks and drove a new Ferrari to the office, a walking advertisement for what his recruits could hope to achieve. Below him, managing the business day to day, was Marco, who was two years younger, several pounds heavier, and did whatever he was told. He wore sweater vests and drove a family car, and the traders called him Homer Simpson behind his back. A rumor went around IDT that the Rossi brothers, whose parents were Scottish, were actually born Paul and Mark Ross but had changed their names to inject a bit of glamour. It was only half true: the Rossi name did come from an Italian grandparent, but the o had been tacked onto their first names in the pits. Goldberg, who was in his mid-twenties, was the surly adolescent of the family. After working as a runner for Paolo, he was brought over to Weybridge to oversee the traders, a responsibility he carried out with an air of barely disguised disdain. He wore a Mr. Grumpy T-shirt around the office and cursed like a cockney sailor.

Nav sailed through the tests, impressing the Rossi brothers by answering the mental arithmetic questions faster than they could finish looking them up on a calculator. But he failed to make much of an impression during the interview. Stick-thin and shifty, he arrived late wearing a suit that looked suspiciously like it belonged to somebody else. He refused to make eye contact and started sentences with “mate” and “bruv” and “the thing is, yeah.” Sarao may have been unpolished, but there were signs of potential. His interest in gaming denoted focus and hand-eye coordination. And he was confident to an almost comical degree. When the panelists asked him what he hoped to achieve in his career, he replied, straight-faced, that he wanted to be as rich as Warren Buffett and start his own charity. In the end, Nav made the cut and was offered a slot on IDT’s second-ever batch of intakes.

IDT’s roots, like those of most of the British futures arcades, can be traced back to 1982 and the opening of the London International Financial Futures and Options Exchange, or Liffe (pronounced “life”). Futures are financial contracts in which one party agrees to sell an asset, say one hundred bushels of wheat, to another for delivery at some future date. Their original purpose was to allow businesses to hedge potential risks. A pig farmer, for instance, who knows she will need to feed her livestock in six months’ time may agree to buy some wheat for a set amount today, eliminating the risk that the price soars between now and then. Of course, it’s possible that the price will go down and she’ll miss out on some potential savings, but the stability and predictability she gains by fixing the cost now make the deal worthwhile. Before long, a second class of investor, the speculator, started turning up at the pits. Speculators buy and sell futures using their own funds with the sole aim of turning a profit. If, for example, a speculator believes the price of wheat will go down because he’s heard there will be a bumper harvest, he’ll sell some wheat futures now in the hope of buying them back at a later date for less. He has no interest in ever actually taking ownership of any wheat; it’s just another type of asset on which to place a wager, no different from buying gold or General Motors stock.

For more than a century, futures were principally traded at the Chicago Board of Trade and the Chicago Mercantile Exchange, but in 1979 Margaret Thatcher was elected prime minister of Britain, ushering in an era of buccaneering capitalism and deregulation. Three years later, a European market focused solely on financial futures—instruments tied to the future value of bonds, equities, foreign exchange, and interest rates as opposed to commodities like wheat or copper—was born. Liffe started out at the Royal Exchange, a grand, cavernous, rectangular coliseum directly opposite the Bank of England. When it was built as a venue for merchants to congregate, in 1571, financial traders were banned because of their “rude manners.” Four hundred years later, they had taken over.

The first participants through Liffe’s doors were given the honorific “Day One Traders.” They included David Morgan, a serial entrepreneur who owned a boutique on Carnaby Street and, according to the legend, made a fortune selling dried fish to Nigeria in the 1970s. Morgan was a small, regimented man with a suave bearing and a tightly clipped mustache that earned him the nickname Colonel. Traders saluted him as they passed. Morgan wasn’t the greatest trader himself, but he could recognize potential in others and started backing new recruits, many of them high school graduates from working-class backgrounds. They adored him, happily sacrificing a share of their profits for the opportunity to make a fortune.

Paolo was among them. Brought up with his brother in south London by their mother, a housewife, and father, a police detective, Paolo found school easy and took his math exam early, but he was restless, and when his friends went off to university, he landed a junior role at the Bank of England. After a couple of fusty years behind a desk learning about interest rates and yield curves, he got a position at a merchant bank, where he worked in a department that used futures to hedge its portfolios. One day a broker invited him on a tour of Liffe. They met by the Royal Exchange’s towering stone columns at 1:25 p.m., five minutes before a big economic announcement was due to be made.

“Even now, thinking about it, the hairs on the back of my neck stand up,” Rossi recalls. “You walk in there and the first thing that hits you is the electricity. And then the noise. Everyone is shouting at each other. All arms and hands in the air, people trying to get people’s attention, girls in booths screaming. It was like going from total silence straight into Wembley Arena for the FA Cup final. I instantly knew I wanted to be there.”

Inside, business was organized around a dozen or so crammed, sweaty, lightly sloping pits where the buying and selling took place. For eight frantic hours a day, traders carried out a relentless stream of orders relayed to them in hand signals from booths running around the edges of the room. Then, when the market closed, the place would empty out and the pubs would fill up. Liffe’s ecosystem was made up of three broad species: brokers from firms like JPMorgan and Goldman Sachs, who wore multicolored jackets and acted as intermediaries, executing orders that came in by phone from customers including global corporations and pension funds; runners, who sported yellow and ferried around messages while trying to avoid projectiles and abuse; and, at the top of the food chain, the red-jacketed “locals,” speculators who carved out a profit buying and selling for their own accounts. They had a reputation for being ruthless, but in always standing ready to take one side of a trade or the other, they provided that essential quality to any market known as “liquidity.”

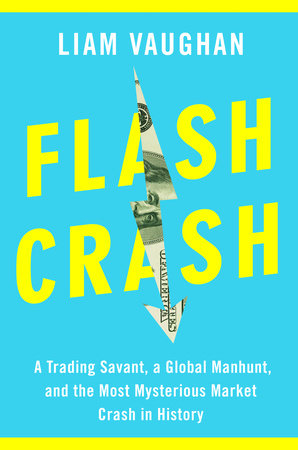

Copyright © 2020 by Liam Vaughan. All rights reserved. No part of this excerpt may be reproduced or reprinted without permission in writing from the publisher.